Technical Info

As a real estate agent, I can go on and on about absorption rates and inventory trends.

You don’t want to hear that.

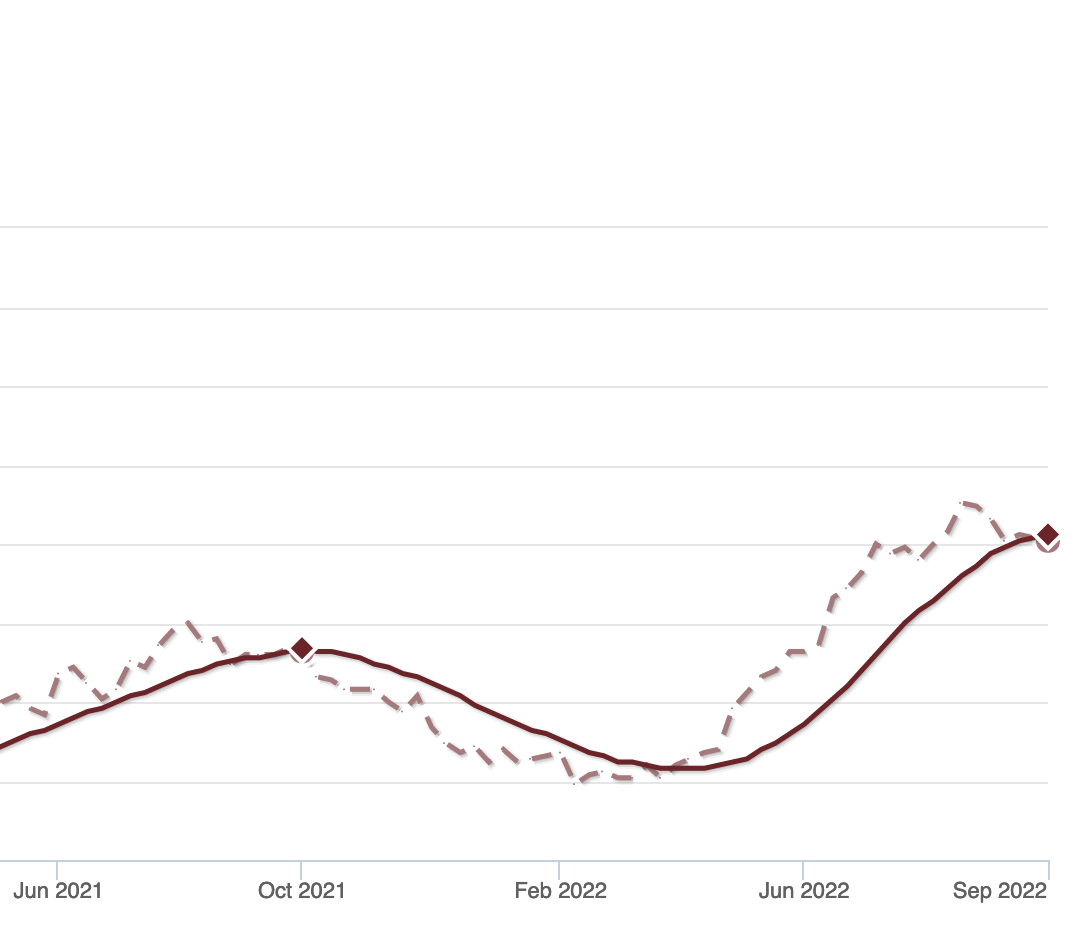

The market has changed drastically in the last, well, since April or so.

That’s when the Fed boosted the interest rate. They’ve boosted a couple times since then.

Mortgage rates have about doubled in the last 6 months.

Inventory is up.

The number of sales is down.

What’s a buyer to do?

The Motivation

Most people don’t buy houses as investments.

No one says “Honey! The absorption rate is over 8 months! Let’s buy a house!”

They buy them because of major life changes.

You get a job in another state.

You retired and sold your family home, so you want to downsize.

You just got married, or got pregnant. (Congratulations!)

Inventory is up, so there are more houses to choose from.

The chance of finding your dream home is higher.

Because interest rates are higher, there are less buyers, so sellers are more likely to drop their asking price, or take a low-ball offer.

(I do love a good low-ball offer.)

The Strategy

It is expected that interest rates will go back down at some point in the future.

Housing prices are expected to stay strong. There will be a small drop in prices, but they won’t crash, and they’ll go back up later.

If, and this is a big “if”, you can handle paying a higher monthly payment, then you can buy the house now, then refinance in 2 years, when rates are expected go lower.

The advantage is that you can find and buy a house now, with less competition and more inventory to choose from.

The disadvantage is that you’re going to pay more in the short term.

The Option

You can rent now, or stay in the same house, for another 2 years.

You’re saving money.

In another 2 years, inventory will come back down, rates will come back down, and the buyers will come back into the market to compete with you.

It will be more difficult to find your dream home, you’ll pay more for it, and maybe not have your offer accepted because someone out bid you.

The Choice

The choice is yours. Everyone’s situation is different.

If you can swing a higher payment in the short term, you can get what you want at a, possibly, reasonably price.

If you can’t swing the payments now, then stay where you are and you haven’t lost anything, but you haven’t gained anything either.

When it’s time to buy in 2 years, with lower interest rates, there will be higher prices, and more buyer competition.

Of course, no one knows the future for sure. You’ll have to do your research, and survey the real estate landscape for yourself.

If you decide to buy now, and you want an experienced team to help you, give us a call.

Leave A Comment