The Tax Lien Process In Yavapai County

Back in real estate school, when I was getting my license, I learned about “tax lien sales”. They sounded like an easy and fun way to make money.

They happen in Yavapai County every February, so we are now officially in tax lien season.

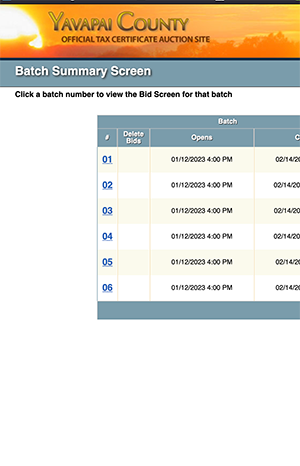

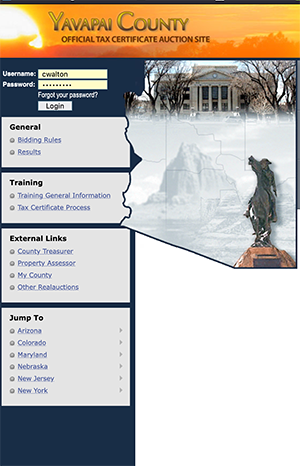

Here’s the website where they happen. yavapai.arizonataxsale.com

The basic idea is that some property owners don’t always pay their property tax on time.

If they don’t pay it for 3 years in a row, the county sells a lien on that property to the public.

The county gets their cash now, and you can make money on the interest on the lien, when the owner does pay.

You can win the chance to buy the tax lien in an online auction.

If you win, and pay for the taxes owed, then you have to wait for 3 years before you can foreclose on that property.

They can pay off their taxes at any time before the 3 years is up, which pays you back your money, plus up to 16% interest on your money.

Not a bad investment.

If they don’t pay it back, and you foreclose, you become the new owner of the property, so you can sell it, and make your millions.

Sounds easy, right?

Getting Started

I wanted to learn how they worked, so the first year I wanted to try to buy some, I waited until the day before the auction was open, because I wanted to get there before it started.

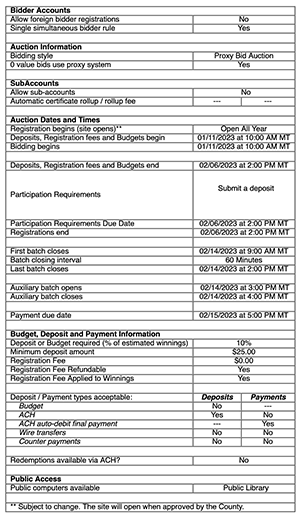

I found out that you have to register a week before the auction even starts.

Find out what the schedule is and make sure you meet all the deadlines. Go to the website and actually read all that stuff you blew past and agreed to. It’s important that you know what it says.

Read This: Yavapai County Tax Lien FAQ

That was discouraging, so it took a couple years before I tried again. This time, I got there early and registered.

Before you can bid on anything, you have to make a deposit of 10% of your total amount you want to buy. If you want to invest $10,000, then you need to deposit $1,000.

The minimum you have to deposit is $25.

If you don’t bid on, or win, anything, you’ll get your deposit back in a couple weeks after the auction closes.

Do Your Research

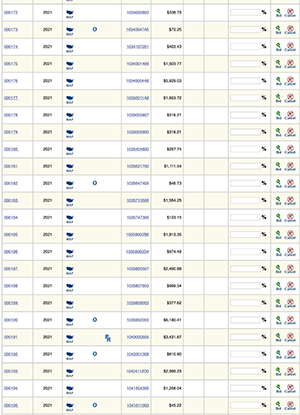

You’ll have access to all of the parcels that will be available to bid on.

Decide what your strategy will be. Do you want to make money or do you want to own land?

I like to only bid on parcels that I’m somewhat familiar with, or at least know where they are.

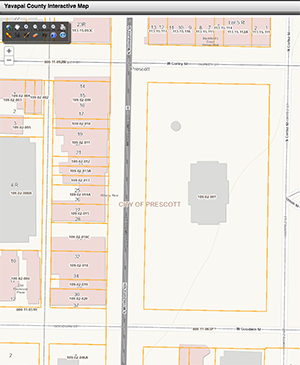

Use the county GIS map to do your research.

Put the parcel number in the “Search” field and look at the results.

Look in the right hand column and find the “Taxes” tab. Click on the “Tax Bill Link”

You can get an idea about the property.

If the house is worth $850,000 and they owe $2,000 in taxes, I’m pretty sure that they’ll pay off that tax and give you your interest.

If the parcel is vacant, in a bad area, with no access, and too small to do anything with, someone just gave up paying taxes and will let it go.

You’ll probably be the proud new owner of a vacant parcel in a bad area, with no access, that’s too small to do anything with.

You should make a list of the parcels you want to bid on, and decide how much you really want each parcel.

I did a color coded spreadsheet the first time I did this.

Just make a quick list.

Now you have a list of parcels and how much you want them, along with how much you’re willing to spend to buy the tax liens.

Keep your total budget in mind while you bid.

Take a deep breath.

Knowledge is power and you have your list in your hand.

The Auction

The auction consists of “Batches”. They bundle a bunch of parcels together in batches to process.

They process one batch each hour. If you don’t get a property you wanted in one batch, you can bid more on parcels in a later batch.

To make a bid, you define the amount of interest you want to receive if they pay off the tax lien, up to a maximum of %16.

They limit the amount of interest that a property owner has to pay if they do pay off the lien.

Of course you want the most money you can get, but the “bidding” part of the auction is that the LOWEST amount of interest WINS the tax lien.

If you bid 16%, but I bid 12%, then I win the bid.

If that other guy bids 5%, then he beats both of us. I hate that guy.

Bidders are only known by their bidder number, but you can see when one person is bidding on multiple parcels.

You can get an idea of what they are trying to do so you might bid against them successfully.

Personally, I’ve targeted specific properties I’ve wanted to own and bid a lower rate so I can get the property.

Investors will bid 16% on every parcel they want, knowing they’ll only win a few, but the ones they do win will pay them a great interest rate on their investment.

You won’t be able to see how many bids on a parcel, or how much they are. That’s why it’s an auction.

As a batch closes, you’ll be able to see what you’ve won or lost, then you can run and adjust bids in later batches.

I must say that one year, I only targeted a few parcels, but I lost them all to lower bids.

You never know what will happen. Bid accordingly.

Auction Results

After the auction is over, you have to pay for all of the tax liens you’ve won.

After the county runs through their process, they’ll mail you receipts and all the paperwork that says you own that tax lien.

Then there’s a parade to celebrate your winning.

Ah. Wait. No… That’s the Super Bowl.

Nothing happens after you win.

You sit and wait.

You forget about that paperwork sitting in your drawer.

The parcel owner has 3 years to pay off the lien and the interest, before you can foreclose.

They can pay it at any time.

Maybe they realize it 2 weeks after the auction and pay off then.

Maybe they wait the full 3 years, then pay it off just before foreclosure.

You have no control over what the parcel owner does.

Then, one day, when you least expect it, you get a letter from the county.

The parcel owner has paid off the tax lien, including the interest rate that you asked for.

You get a check for the total.

Now you get to celebrate.

You have successfully invested in, and profited from, a tax lien sale. Congratulations.

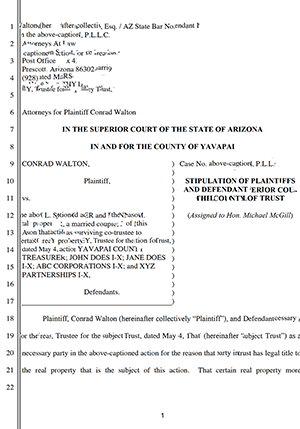

Foreclosure

If that magical day never comes when you get a check in the mail, you just keep waiting.

After 3 years of waiting, you can foreclose.

Now, everything that I’ve read makes the foreclosure process sound easy.

It’s not.

I thought I could do it myself. I’m a smart guy. I know things.

Nope. Get a lawyer. They cost money.

The foreclosure process can be easy or complicated.

Try to get a lawyer that charges by the hour and hope your case is easy.

I ended up with 2 parcels once. One parcel had other liens or possible ownership issues with 4 other parties.

Each party had to be notified and negotiated with.

The entire process took a year and a half, and cost me thousands of dollars in lawyer’s fees.

In the end, I did sell the parcel and make money on the deal, but learned to only bid on parcels that look simple, as far as ownership and other liens.

Look at the history on the county GIS page for ownership issues.

If you’re going to battle for them, they should at least be worth something if you want to sell them.

It was a long, hard fought battle, but I did make money in the end, and I’d do it all over again.

Invest Wisely

Tax liens can make you some money. They can teach you some lessons.

They can drag you down, and beat you, then take your money.

You might end up with a worthless piece of property.

You might end up on a beach, sipping a cold adult beverage.

Do your research.

Don’t bid any more than you can afford to lose.

Above all, let’s be careful out there.

See you at the auction.

Leave A Comment